Is An IVA Right For You? - IVA Advice

Is An IVA Right For You? - IVA Advice

We could write off up to 85% of your unaffordable debt

Table of Contents

Is An IVA Right For You?

Whether an IVA (Individual Voluntary Arrangement) is right for you or not will largely depend on your personal situation e.g. debt level, number of creditors, affordability etc.

An IVA is a piece of legislation that enables you to agree an affordable monthly payment to your creditors for a period of approximately 6 years. At the end of your IVA term, any remaining debt will be written off.

This is becoming an increasingly popular way of becoming debt free. So if you owe money to more than one creditor and have a minimum of around £5,000 worth of debt that you are struggling to pay, then an IVA could be suitable for you.

Continue reading to get the help and guidance you need.

Do I Qualify for an IVA?

In order to qualify for an IVA, you must meet the following criteria:

Have £5000 or more unsecured debt

Owe money to two or more creditors

Live in England, Wales or Northern Ireland

Have a regular income and be able to meet a monthly payment of at least £85.

How Much Does An IVA Leave You To Live On?

When considering an IVA, it is natural to think about how you will live and what you will be able to afford during the five year IVA period. An IVA is one of the most affordable debt solutions available, but what does that mean for you personally? In this section, we will discuss how much an IVA will leave you to live on so you can make the best decision for you.

First of all, it is always a good idea to cover the basics of what an IVA is and you can find a comprehensive guide here.

When answering the question of how much would an IVA leave you to live, it really does come down to individual circumstances, but one key rule of an IVA is that it is calculated based on what you can afford rather than how much debt you owe. During the application process our advisors will take you through an income and expenditure questionnaire to discover what you can realistically afford each month.

At each stage of an application, a vital part of the process is that we are not setting you up to fail. If we don’t think you can afford an IVA, we won’t allow you to start one and we will discuss other options.

How Do We Calculate What You Can Afford?

The first thing we do is talk about your monthly income: How much it is, where it comes from and whether there is a known significant risk that it might stop or be reduced.

We then discuss all of your fixed essential outgoings including, mortgage or rent payments, utility bills, food costs and any secured debt repayments that wouldn’t be allowed to be part of your IVA. By subtracting your outgoings from your income, we can calculate your disposable income and therefore what you can afford to put towards your IVA each month.

As well as ensuring that you can afford the IVA and that it has a great chance of lasting its full five year term, we also have to consider the interests of your creditors, since they also have to agree to the IVA.

A simple example of this is that if you earn £1800 a month and your outgoings are calculated as £1600, then you would be expected to pay £200 towards your IVA.

In order to do this we need to ensure that what you can afford each month, once multiplied by five years of your payments, equates to approximately 25% of the overall debt amount you owe. This is usually around the minimum amount they will accept.

Annual Additional Income Threshold.

Once your IVA has been approved, your Insolvency Practitioner will calculate how much your income could increase by before you would need to increase your IVA repayments. This normally sits at around 10%.

So, if you earn £1000 a month, you would be able to increase that by £100 before you would need to contact you IP and have your payments adjusted.

If your earnings increase by more that 10%, then 50% of the amount that is above the 10% increase would need to be added to your repayments.

That means that if you were earning £1000 a month and your income per month increased by £200, half of that (£100) would need to be added to your monthly repayments.

Can IVA Repayments Be Reduced?

If, once your IVA has begun, you find that you are struggling to make your repayments, then it is possible to have them reduced.

If you only require a reduction of up to 15%, then this can be done by your IP. If you want to reduce your payments by more than 15%, then your IP would need to get permission from your creditors. This can also often incur a fee.

If you feel like your repayment issues are temporary, then your IP could potentially defer one of your payments, reduce or pause your repayments for a fixed period or, in some cases, even settle your IVA early.

What Other Impact Could An IVA Have On My Life?

Before you apply for an IVA, it is important to think about whether you own any property or whether your career could be affected.

Property

When applying for an IVA, your Insolvency Practitioner will consider any equity you may have in your property and take that into account. If you sold your property, could that be enough to cover your debts? The IP will consider if you share the equity with another individual, but if your share is above £5000 you could be asked to re-mortgage your home and to put 85% of that equity into the IVA.

It is important to note, that you will never be expected to sell your property.

Career

It is important to be aware that some professions expect you to declare that you are entering into an IVA agreement to your employer. It can be a good idea to check your employment contract to see if this applies to you.

If you work as an accountant or solicitor, in the police, prison service or fire service, as a bank clerk or a person in a position of financial responsibility, then this could affect your job.

The vast majority of professions are not impacted by an IVA.

Can Creditors Take My Possessions Whilst Arranging an IVA?

When you and your Insolvency Practitioner are arranging your IVA, you can decide which assets to include or exclude. Your IP may ask you to sell any items you choose to exclude, but you can choose whether or not to consent to this.

The following items would be deemed essential and will never be included:

Items related to children e.g. pushchairs etc.

Electrical equipment e.g. TVs, computers etc.

Furniture

Kitchen equipment e.g. white goods

Medical equipment e.g. wheelchairs

Books

Clothing

The following assets can affect your IVA and should be declared to your IP:

ISAs

Endowments

Shares

Investments

Insurance policies

IVA Help and Guidance

What Is An IVA?

An IVA can be a great, positive way to help with your debt. Allowing you to continue living your life without the stress of being chased by your creditors. Click to find out more about what an IVA is.

Is An IVA Right For You?

Whether an IVA (Individual Voluntary Arrangement) is right for you or not will largely depend on your personal situation e.g. debt level, number of creditors, affordability etc. Click to find out more.

How Does An IVA Work?

An Individual Voluntary Arrangement (IVA) is a debt solution where you agree with your creditors to pay all or part of your debts. When it is completed, any remaining debts are written off. Take a look at our article to find out more.

Which Debts Can Be Included In An IVA?

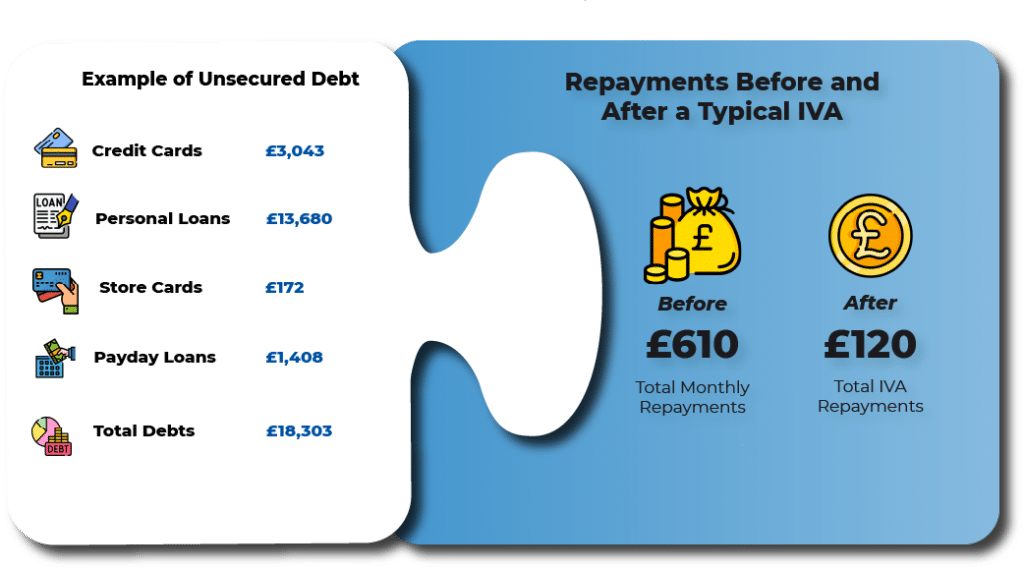

Many kinds of debts can be included in an IVA. IVAs are limited to unsecured debts but by solving your unsecured debt problems, you may find paying any secured debt much easier.

How Do I Apply For An IVA?

Applying for an IVA (Indivudual Voluntary Arranagement) is a fairly straightforward process. Click the button below and a member of our team will contact you and guide you through the process.

What Are The Pros & Cons Of An IVA?

As with many things in life, there are benefits and consequences we need to consider. Take a look at our Pros and Cons article to find out whether an IVA is right for you

Does An IVA Have Fees?

Setting up an IVA does incur some costs; however, you will not be expected to pay anything up front at the beginning of the arrangement and there will be no surprise costs at the end of the arrangement.

Are IVAs Worth It?

When looking into how an IVA works, there are some features that do appear to be too good to be true, so it is understandable that some people are extremely cautious and even cynical when thinking about whether to proceed.

Is an IVA a Bad Idea?

Whether an IVA is a good or bad idea is largely dependent on your financial circumstances. Of course, every debt solution is going to have its advantages and disadvantages. These need to be considered and weighed up so that you can make an informed choice.

Do You Lose Assets With An IVA?

Assets are the things you own, whether that’s a house, car or electronic equipment. Many people, when entering any debt solution, are often concerned about how much they will lose and to which extent their lives will be altered. Read on to find out more about how an IVA might impact on your assets.