IVA Pros and Cons | Is An IVA Worth It?

IVA Pros and Cons | Is An IVA Worth It?

Clear Your Debt With One Affordable Monthly Payment

- Clear Your Debt With One Affordable Month Payment

- Free Consultation

- Find The Solution That Best Fits Your Needs

Table of Contents

What Is An IVA (Individual Voluntary Arrangement)?

An Individual Voluntary Arrangement (IVA) is a formal, legally binding debt solution. This means that it is officially legislated and controlled by the UK government. It is managed by a licensed Insolvency Practitioner.

Once you have entered into an IVA, any charges or interest attached to your unsecured debt are frozen. You will then be expected to pay a monthly contribution to your Insolvency Practitioner who will use it to pay off a portion of your debt, along with other fees associated with the IVA.

An IVA tends to last between 5-6 years, after which, any debt included in the agreement that is still outstanding, will be written off. This typically tends to be around 75% of the original debt, but can be as much as 85%.

IVA Pros - What Are The Advantages of an IVA?

When considering whether an IVA is right for you, there are several IVA Pros and Cons to consider:

There will be no upfront or surprise fees – During the application process, you will be given a copy of your agreement, clearly stating your fees. All fees are covered by the monthly payment you make, so you will never be asked to pay anything up front or at the end of the IVA period.

You unsecured creditor will no longer be able to contact you or take any action against you – By agreeing to your IVA, your creditors are also agreeing to cease any action they may be taking against you, leaving you in peace.

Once the IVA is agreed, creditors who voted against it are still bound by it – Your creditors will literally vote for or against your IVA proposal. If the majority say yes, then the rest of your creditors are legally bound to follow.

All charges and interest relating to the debt is frozen – While your IVA live, your creditors can not add any fees or interest to the balance. However, it is worth noting, that should your IVA fail, perhaps as a result of you not keeping up with repayments, then charges and interest can be applied from that point forward.

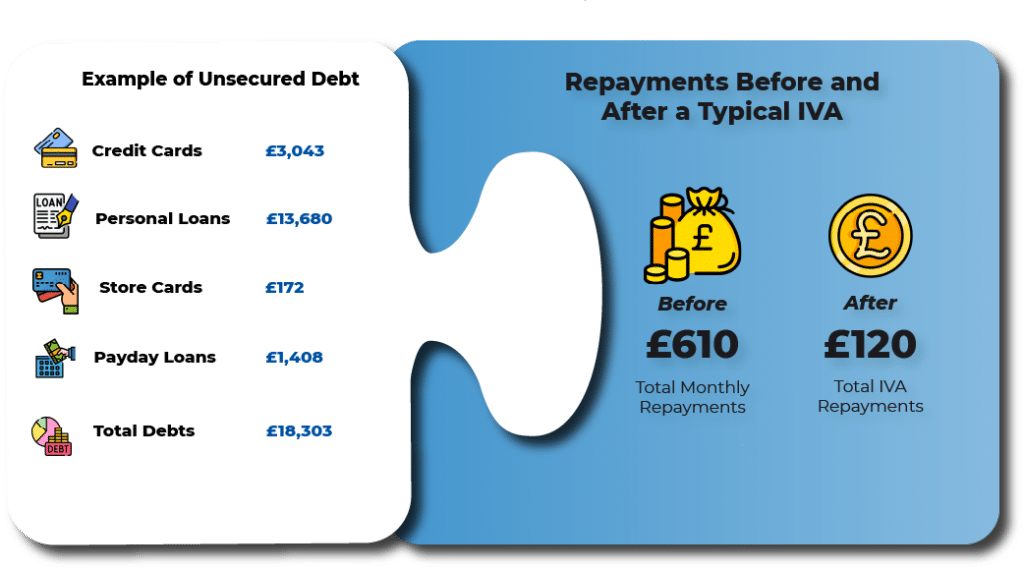

You will make one single affordable payment each month – As part of the application process, your Insolvency Practitioner will judge how much you can afford a month towards your debt. You will have the opportunity to discuss all of your incomings and outgoings so we can find the best solution for you.

If your financial situation changes you could be eligible for a payment holiday or for the terms of the IVA to be adjusted – If you circumstances change for the worse, then as long as you are honest and open about this, you may be able to take advantage of some payment holidays, or to have the IVA adjusted.

At the end of the IVA, all remaining debt will be written off – Once your IVA period has ended, any debts that were agreed in the IVA at the beginning that still have an outstanding balance, will be written off.

Your home will not be at risk as a result of the IVA – An IVA should not put your home at risk. If you have a mortgage then this will not be able to be included in an IVA, so as long as you can keep up with your repayments as normal, your home is safe.

IVA Cons - What Considerations Do I Need To Make?

When thinking about whether an IVA is right for you, here are some things to consider:

Only certain debt can be included in an IVA – Your Insolvency Practitioner will only be able to include unsecured debt into the agreement. For more information take a look at our What Debts Can Be Included in an IVA? page

Creditors may not agree to the IVA – When presented with your IVA Proposal, your creditors will be asked to vote on whether they think it should go ahead. Occasionally, you may lose this vote.

If you have equity in your property, then you could be forced to re-mortgage, release the equity and have it included in your IVA – If your mortgage has a fixed rate, then at some point during your IVA, you will likely need to remortgage your property. At this stage you could be asked to release any equity you have in your property and put it towards your debt.

You may be forced to hand over any extra money you receive – If you receive funds greater than £500 as a result of inheritance or other such circumstances during the terms of the IVA, then you will need to inform your IP who will introduce them into your arrangement

If you fail to make payments, then your IVA could fail – if this happens, then your creditors will be able to begin chasing your arrears again, potentially adding interest and charges.

If your financial situation changes then your IP could request an amendment to your arrangement with your creditors. – If your creditors refuse to comply with this, then your IVA could fail.

IVAs are added to the Insolvency Register – This is a public record, so anyone looking for this information could potentially find your details.

An IVA will have a negative impact on your credit rating for six years – This is a negative, but if you have missed payments on your debt already, your rating could already be low.

A failed IVA could lead to you being made bankrupt – If you miss payments and your IVA fails, then your creditors could petition for you to be made bankrupt.

IVA Guides and Information

What Is An IVA?

An IVA can be a great, positive way to help with your debt. Allowing you to continue living your life without the stress of being chased by your creditors. Click to find out more about what an IVA is.

Is An IVA Right For You?

Whether an IVA (Individual Voluntary Arrangement) is right for you or not will largely depend on your personal situation e.g. debt level, number of creditors, affordability etc. Click to find out more.

How Does An IVA Work?

An Individual Voluntary Arrangement (IVA) is a debt solution where you agree with your creditors to pay all or part of your debts. When it is completed, any remaining debts are written off. Take a look at our article to find out more.

Which Debts Can Be Included In An IVA?

Many kinds of debts can be included in an IVA. IVAs are limited to unsecured debts but by solving your unsecured debt problems, you may find paying any secured debt much easier.

How Do I Apply For An IVA?

Applying for an IVA (Indivudual Voluntary Arranagement) is a fairly straightforward process. Click the button below and a member of our team will contact you and guide you through the process.

What Are The Pros & Cons Of An IVA?

As with many things in life, there are benefits and consequences we need to consider. Take a look at our Pros and Cons article to find out whether an IVA is right for you

Does An IVA Have Fees?

Setting up an IVA does incur some costs; however, you will not be expected to pay anything up front at the beginning of the arrangement and there will be no surprise costs at the end of the arrangement.

IVA FAQs

Are IVAs Worth It?

When looking into how an IVA works, there are some features that do appear to be too good to be true, so it is understandable that some people are extremely cautious and even cynical when thinking about whether to proceed.

Is an IVA a Bad Idea?

Whether an IVA is a good or bad idea is largely dependent on your financial circumstances. Of course, every debt solution is going to have its advantages and disadvantages. These need to be considered and weighed up so that you can make an informed choice.

Do You Lose Assets With An IVA?

Assets are the things you own, whether that’s a house, car or electronic equipment. Many people, when entering any debt solution, are often concerned about how much they will lose and to which extent their lives will be altered. Read on to find out more about how an IVA might impact on your assets.