Have You Been Contacted By A Bailiff? – What You Need To Know

Have You Been Contacted By A Bailiff? – What You Need To Know

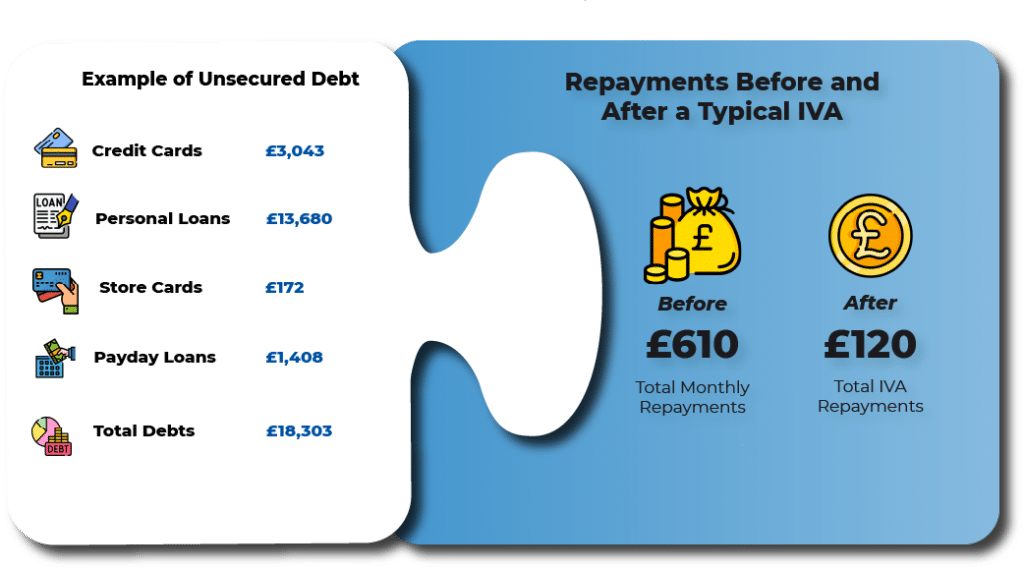

Instead of paying your bailiff, we could write off up to 85% of your unaffordable debt

Table of Contents

Introduction

If you have recently received a letter through the post from ‘enforcement agents’, telling you that they intend on visiting your home to collect payment, then you are probably feeling a significant amount of worry and stress.

The bad news is that bailiffs do have the right to enter your property and seize possessions, but the good news is that with the right help, you can stop this from happening, no matter how much debt you are in.

This article refers to the operations and laws relating to bailiffs in England and Wales.

What Is A Bailiff?

A bailiff is an individual who has been given special powers by the courts to collect unpaid debts.

They will usually arrive at your house or place of work and demand immediate payment in full. If you are unable to do this, then they will attempt to take your possessions e.g. televisions, jewellery or vehicles. These items will then be sold at auction and the money used to pay your debts. Bailiffs will most likely not accept any type of payment plan.

A bailiff can either work as a court official or for various private bailiff companies. They can sometimes be known as: County Court Bailiffs; Family Court Bailiffs; Certified Enforcement Agents/Officers; High Court Bailiffs; Civilian Enforcement Officers.

The different job titles can mean that the bailiff works under slightly different rules, but their roles is generally the same.

Will A Bailiff Enter My House?

If you receive a letter titled ‘Notice of Enforcement’, then after 7 days, if you do nothing, bailiffs will most likely arrive at your property. If they arrive before 7 days has elapsed, then you can refuse them entry.

Once you receive the ‘Notice of Enforcement’, it is essential that you seek debt advice to avoid the forthcoming visit. Beginning the application process for a debt solution can often force bailiffs and debt collectors to stop their actions.

What Sort Of Possessions Will Bailiffs Take?

Bailiffs can take items that are considered luxury or non-essential for example:

Televisions

Games Consoles/Computer equipment

Jewellery

Vehicles that you own and are on your property

They cannot take items that are considered essential for living such as:

Clothing

Cooking equipment or items

Work tools with a value of under £1350

Items belonging to other people (you may be required to prove this)

During their first visit, they will usually compile a list of items they wish to seize, without actually taking them.

Will Bailiffs Enter My Home If I Am Not There?

If bailiffs arrive at your property when you are not there, then they can only enter if a door has been left unlocked. They can not damage doors or windows to gain entry unless it is relating to a criminal debt.

There are other regulations that bailiffs must follow:

They can’t enter your home by force, meaning they can’t push past you or hurt you in any way

They can’t enter if only children under 16 are present

They can’t enter if only vulnerable people are present e.g. people with disabilities or the elderly

They can’t enter between 9pm and 6am

They can’t enter through windows etc. Only doors.

What Can I Expect to Happen If I am Visited by Bailiffs?

When bailiffs arrive at your door, they should identify themselves. If they don’t then you should always demand that they do so. All bailiffs should carry a certificate from their enforcement agency and an ID badge.

Before even considering allowing entry, try to get a telephone number for their agency, so you can ring and check that they are genuine.

You should also ask for a detailed written breakdown of the money they say you owe.

If you let them in, then on their first visit, they will often create a list of items they wish to take. It is usually on their second visit that they will actually take anything. If they are unable to satisfactorily reclaim the debt then they may return for a third time.

It is often suggested that even if the bailiffs do successfully identify themselves, do not grant them entry to your home. There is still likely to be a better option for you!

What Should I Do if I'm Being Chased by Bailiffs?

The most important thing to realise is that you should not simply avoid your debt or use more credit to pay your debts.

There is still time to seek help and begin to deal with your debt properly. An IVA can be a great way of clearing your debts. Read through our IVA page to find out more.

IVA Information and Guides

What Is An IVA?

An IVA can be a great, positive way to help with your debt. Allowing you to continue living your life without the stress of being chased by your creditors. Click to find out more about what an IVA is.

Is An IVA Right For You?

Whether an IVA (Individual Voluntary Arrangement) is right for you or not will largely depend on your personal situation e.g. debt level, number of creditors, affordability etc. Click to find out more.

How Does An IVA Work?

An Individual Voluntary Arrangement (IVA) is a debt solution where you agree with your creditors to pay all or part of your debts. When it is completed, any remaining debts are written off. Take a look at our article to find out more.

Which Debts Can Be Included In An IVA?

Many kinds of debts can be included in an IVA. IVAs are limited to unsecured debts but by solving your unsecured debt problems, you may find paying any secured debt much easier.

How Do I Apply For An IVA?

Applying for an IVA (Indivudual Voluntary Arranagement) is a fairly straightforward process. Click the button below and a member of our team will contact you and guide you through the process.

What Are The Pros & Cons Of An IVA?

As with many things in life, there are benefits and consequences we need to consider. Take a look at our Pros and Cons article to find out whether an IVA is right for you

Does An IVA Have Fees?

Setting up an IVA does incur some costs; however, you will not be expected to pay anything up front at the beginning of the arrangement and there will be no surprise costs at the end of the arrangement.