IVA Loopholes – What Not To Do When On An IVA

IVA Loopholes – What Not To Do When On An IVA

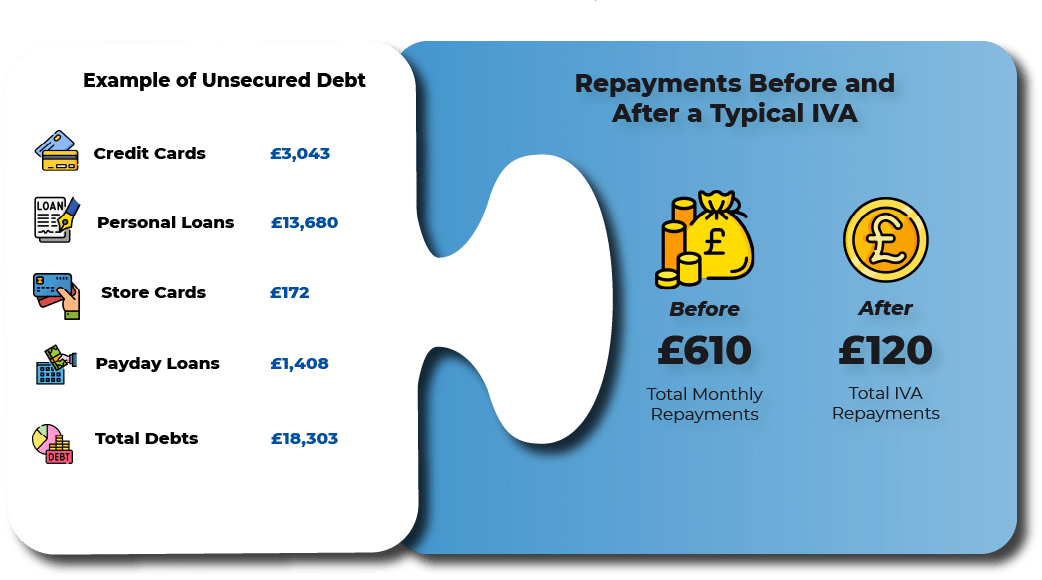

We could write off up to 85% of your unaffordable debt

Table of Contents

Introduction

An IVA (Individual Voluntary Arrangement), under the correct circumstances, can be an effective way of tackling debt if you are struggling to afford your repayments, but it does have its rules and regulations and its consequences if you break them.

So, whether you are already on an IVA or considering whether one is right for you, it is always a worthwhile activity familiarising yourself with the rules to ensure you stay on the right track.

In this article we will cover some the common mistakes that some IVA clients make and what the consequences of those errors could be. We will also cover how your Insolvency Practitioner will monitor the situation.

Hiding Money

When you first sign up for an IVA, you will undergo an income and expenditure check, whereby your incomings and outgoings are assessed to find out what your monthly disposable income is. This amount is then used as your monthly IVA payment towards your debt. Since, in this test, your outgoings will include all the essentials like food and clothing and even some money for socialising etc, it is generally considered that whilst on an IVA, you can still live a good quality of life.

Hiding money can fall into two main categories:

- A key rule of an IVA is that, should you receive money in excess of £500, in the form of inheritance, a gift or lottery/scratch card win etc. then you must disclose that money to your Insolvency Practitioner, who will expect to take whatever money is in excess of that £500.

Here are two examples of this:

You win £600 on a scratch card. You get to keep the first £500, but the other £100 will go towards your IVA.

Or

You receive £2000 through an inheritance windfall. You get to keep the first £500 and the remaining £1500 will go towards your IVA.

It is worth noting though, that should you receive an amount of money that is greater than your overall debt, you can use this to settle the IVA early, rather than lose out on everything over the £500 threshold.

- The second key rule is regarding your income from your job. If, during the term of your IVA you receive overtime or a bonus greater than 10% of your usual amount, you will be required to declare this to your Insolvency Practitioner, who will likely take half of the amount that is in excess of the 10%.

An example of this is that if you normally earn £1000 a month and you received a bonus of 20%. You would receive £1200 that month and would be allowed to keep the first 10% (£100) and then the other 10% would be split meaning that you would keep one half of that and the other would go into the IVA.

So…

£1000 would be your basic pay.

You automatically get to keep 15% of your bonus. The first 10%, then half of what is left.

If you receive a permanent pay rise, then you would need to contact your Insolvency Practitioner who will take you back through your Income and Expenditure assessment to see what your new monthly repayment should be.

Stopping Repayments

It is important to remember that your IVA is a legally binding agreement between you, your creditors and your Insolvency Practitioner. Think of it as an agreement. In exchange for you paying your monthly amount, they (your creditors) agree to stop pursuing the debt and to stick to their end of the deal and write off a portion of that debt when the term of the IVA is completed.

If you do not stick to your end of the deal, they won’t stick to theirs.

This means that should you fail to make repayments or fail to cooperate in attempts by your IP to resolve the situation, the IVA will fail. If this happens, then you will be eligible to pay back either all or at the very least, a large proportion of the debt originally included in the agreement. This would also inevitably lead to your creditors restarting their efforts to chase the debt.

If, at this point, it is considered unlikely that you would be able to repay the debt, then another consequence of a failed IVA is that either your creditors or even your Insolvency Practitioner, could then petition for you to be made bankrupt.

What Could a Typical IVA Do For Me?

Take Our More Credit

During your IVA term, you will also be prohibited from taking out new debts greater than £500.

Inevitably, your IVA will affect your credit rating making it difficult, in the beginning, to get new credit. However, some IVA clients do manage to take out fresh debt regardless of their credit score. If the debt is greater than £500, then this is not allowed.

Gambling

Whilst you are engaged with your debt solution, your Insolvency Practitioner will also be on the lookout for what they consider to be potentially dangerous spending habits and this includes gambling.

How Would Your Insolvency Practitioner Find Out What You’re Doing?

During you IVA application process, your Insolvency Practitioner will look at several details regarding your financial situation, in order to assess your personal circumstances. This will include the debt itself, but also bank account statements. In the first instance, this will help verify your income and expenditure assessment, but it is also used to identify any problematic spending that may be taking place, such as gambling.

If you go ahead with your IVA, then you will be agreeing to have this process repeated each year. So, any large amounts of unexplained or undeclared money that enter your bank account, or any increase of income from your job or any evidence of gambling, will most likely be found by your IP, potentially resulting in the consequences highlighted earlier in this article.

So, if you are considering entering into an IVA or if you are already in one, be very careful if you are looking to find those IVA Loopholes! The consequences could be more severe than you think.

IVA Guides and Information

What Is An IVA?

An IVA can be a great, positive way to help with your debt. Allowing you to continue living your life without the stress of being chased by your creditors. Click to find out more about what an IVA is.

Is An IVA Right For You?

Whether an IVA (Individual Voluntary Arrangement) is right for you or not will largely depend on your personal situation e.g. debt level, number of creditors, affordability etc. Click to find out more.

How Does An IVA Work?

An Individual Voluntary Arrangement (IVA) is a debt solution where you agree with your creditors to pay all or part of your debts. When it is completed, any remaining debts are written off. Take a look at our article to find out more.

Which Debts Can Be Included In An IVA?

Many kinds of debts can be included in an IVA. IVAs are limited to unsecured debts but by solving your unsecured debt problems, you may find paying any secured debt much easier.

How Do I Apply For An IVA?

Applying for an IVA (Indivudual Voluntary Arranagement) is a fairly straightforward process. Click the button below and a member of our team will contact you and guide you through the process.

What Are The Pros & Cons Of An IVA?

As with many things in life, there are benefits and consequences we need to consider. Take a look at our Pros and Cons article to find out whether an IVA is right for you

Does An IVA Have Fees?

Setting up an IVA does incur some costs; however, you will not be expected to pay anything up front at the beginning of the arrangement and there will be no surprise costs at the end of the arrangement.

Are IVAs Worth It?

When looking into how an IVA works, there are some features that do appear to be too good to be true, so it is understandable that some people are extremely cautious and even cynical when thinking about whether to proceed.

Is an IVA a Bad Idea?

Whether an IVA is a good or bad idea is largely dependent on your financial circumstances. Of course, every debt solution is going to have its advantages and disadvantages. These need to be considered and weighed up so that you can make an informed choice.

Do You Lose Assets With An IVA?

Assets are the things you own, whether that’s a house, car or electronic equipment. Many people, when entering any debt solution, are often concerned about how much they will lose and to which extent their lives will be altered. Read on to find out more about how an IVA might impact on your assets.