Apply For An IVA

Clear Your Debt With One Affordable Monthly Payment

- Clear Your Debt With One Affordable Month Payment

- Free Consultation

- Find The Solution That Best Fits Your Needs

Table of Contents

What Is An IVA (Individual Voluntary Arrangement)?

An IVA can be a great, positive way to help with your debt. Allowing you to continue living your life without the stress of being chased by your creditors.

An Individual Voluntary Arrangement (IVA) is a debt solution where you agree with your creditors to pay all or part of your debts. This agreement is set up and managed by an Insolvency Practitioner (IP), who will receive an agreed monthly payment from you and will divide it amongst your creditors.

If you apply for an IVA, then this agreement could allow you to write off up to 85% of your total debt based on government legislation and will often give you a greater level of control than bankruptcy.

IVA Application

Signing up to a debt solution is a significant event in your life, so it is important to gather as much information as possible, so you can make an informed decision as applying for an IVA is not your only option.

While researching your options before you register or sign up, you may find our articles on IVAs and how they work.

Apply For IVA

Once you feel ready, fill in our form and a member of our IVA team will contact you. Alternatively, call our team on 0800 698 0174.

Shortly after filling in our online form, a member of our team will contact you. Our experienced advisors will be able to guide you through your options discovering which one best applies to you, ensuring that, even if we cannot help you ourselves, we can point you in the right direction of help appropriate to your personal circumstances.

In order to determine which course of action is right for you, we will discuss your debt. This will involve how many debts your have, who you owe money to and how much you owe to each business. If you are not sure about the details of your debt then we could always run a credit check for you.

What Happens If I Go Ahead With The IVA Application?

After you have spoken to a member of our team and decided that an IVA is the best option for you, your application will be passed over to an IVA Drafter. At this stage of the process, all of your personal and financial details will be gathered in order to create your IVA Proposal.

Your IVA Proposal is a formal document that is sent to your creditors. This gives your creditors a complete picture of your financial circumstances.

What Happens When I'm In An IVA, Will Creditors Ask Me For Money?

Once your IVA has been agreed and set up, your creditors can no longer take action against you and won’t be able to contact you, but it will affect your credit rating for six years, making it difficult to get further credit during this period. Your details will also be placed on The Register of Insolvencies, which is a public record, while you clear your debts.

For the duration of your IVA, all fees and interest relating to your debt is frozen and once completed, the remainder of your debt is written off, allowing you to begin again, debt free.

This agreement is available to residents of England, Wales and Northern Ireland. If you live in Scotland, then you could pursue an agreement called a Trust Deed to help you with your debt.

What Information Will We Need To Apply For An IVA?

During the IVA application process, there are several documents that we will request.

Apply for an IVA

We will ask you to provide:

- Photo ID

- Rent Agreement or Mortgage Statement

- Latest 3 Months of wage slips

- Latest 3 months of bank statements

- Council Tax and Utility bills

- HP agreement if appropriate

- Recent statements from any other creditors you may have.

Which information you are asked for will largely depend on your personal circumstances and as such, the above list is to be used purely as a guide.

What Other Information Will I Be Asked For During My IVA Application?

There will also be a discussion regarding your other living expenses and how you spend your money, such as food bills and travel expenses. This allows your IVA Drafter to determine your affordability, ensuring you don’t sign up to an IVA that isn’t appropriate for you, it is important that the rules and regulations are met. It would not be great to learn at a later date that an IVA solution for your debts and finances wasn’t the best option.

IVA Application - Drafting Process

Once all of the information has been gathered, your IVA Drafter will then ‘draft’ your IVA. This means that they will raise the legal documentation.

The Drafter will check through the information you have provided and will ensure that everything is in order to successfully proceed with your proposal, including making sure that all evidence of your circumstances are available should your creditors request more details.

Meeting of Creditors - Do The Creditors Actually Meet And Discuss My Debt?

The Meeting of Creditors (MOC) is the process by which your creditors vote on in favour of, or against your IVA proposal.

It isn’t an actual meeting, but instead refers to a period of time in which they have to respond to the proposal.

All of the creditors included in the IVA are entitled to vote, however they do not have to. In fact, any creditors that choose not to vote are in effect, agreeing to the proposal. So any creditors who do wish to reject the IVA proposal, must actually vote against it.

To apply for an IVA how many creditors need to vote in favour?

The IVA Proposal needs 75% of the creditors vote in favour to be accepted.

or

Enough creditors to vote in favour whom make up 75% of the overall debt amount.

Once the proposal has been accepted, the IVA becomes binding for all of the creditors involved, regardless of whether they voted for or against.

What Can Go Wrong With My Proposal?

Of course, there are circumstances where creditors do vote against an IVA proposal and it does get rejected, however many IVA companies get to know the habits and behaviours of creditor companies and are often able to predict when this might happen, allowing them to modify the proposal accordingly.

Creditors will occasionally question any spending that is above government parameters. This means that if your food bill is higher than average, your creditors may require justification for this.

In some circumstance, creditors may request that modifications be made to the proposal, so instead of it being rejected out of hand, it can just be changed. You could end up in a far better financial position without increasing your income.

What Difference Could A Debt Write Off Solution Make To Me And My Money?

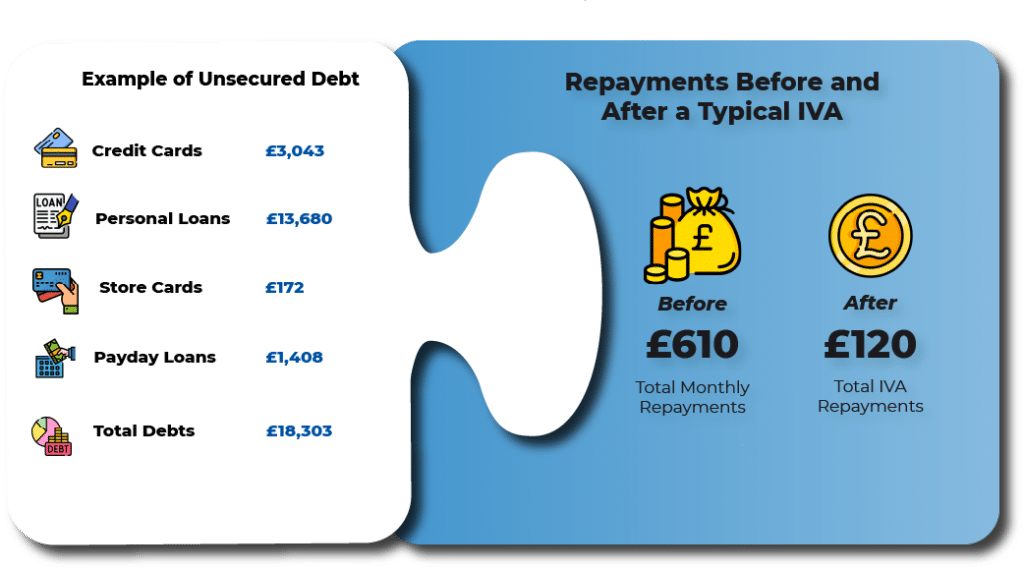

The image below is based upon a genuine case we have been able to help with.

As you can see, the individual concerned had a significant debt of £18,303 and was expected to pay an amount per month they couldn’t afford.

During the IVA Consultation

It was established that once all bills and reasonable lifestyle costs had been taken into account (not including their debt repayments), they had £120 per month left.

That meant that without an IVA, they were trying to pay £610 per month towards their debt with only £120 available. Instead the £120 became their IVA repayment, meaning they could get on with their lives knowing they could now afford their debts.

The seriousness of their situation had played heavily on their mind but now they could budget sensibly having had expert advice. Their mental health was being put under tremendous pressure but now they can genuinely see a way forwards to becoming debt free.

It is relatively easy for a credit card to get out of hand or maybe a vehicle purchase with a monthly payment is just too much, with an agreed IVA it is possible to get your spending under control.

Is An IVA Right For You For Debt Relief Or Debt Solution?

Whether an IVA (Individual Voluntary Arrangement) is right for you or not will largely depend on your personal situation e.g. debt level, number of creditors, affordability etc.

An IVA is a piece of legislation that enables you to agree an affordable monthly payment to your creditors for a period of approximately 6 years. At the end of your IVA term, any remaining debt will be written off.

This is becoming an increasingly popular way of becoming debt free. So if you owe money to more than one creditor and have a minimum of around £5,000 worth of debt that you are struggling to pay, then an IVA could be suitable for you.

Do I Qualify for an IVA?

In order to qualify for an IVA, you must meet the following criteria:

- Have £5000 or more unsecured debt

- Owe money to two or more creditors

- Live in England, Wales or Northern Ireland

- Have a regular income and be able to meet a monthly payment of at least £85

IVA Application Successful

What Debts Can Be Included in an IVA?

Many kinds of debts can be included in an IVA. It is important to realise that this is not limited to borrowings to finance companies but can also include HMRC debts, Council Tax debts and even debts to friends or family. It is, however limited to unsecured debts, so any debt secured against a property or vehicle, for example, would not be allowed to be included. Below is a list of debts that can be included in your IVA.

Many kinds of debts can be included in an IVA. It is important to realise that this is not limited to borrowings to finance companies but can also include HMRC debts, Council Tax debts and even debts to friends or family. It is, however limited to unsecured debts, so any debt secured against a property or vehicle, for example, would not be allowed to be included. Below is a list of debts that can be included in your IVA.

Will I Need To Pay Any IVA Fees?

Setting up an IVA does incur some costs; however, you will not be expected to pay anything up front at the beginning of the arrangement and there will be no surprise costs at the end of the arrangement. All costs are deducted from your monthly payments as you go along and will be clearly stated in your proposal.

Once your monthy contribution has been stated in your proposal, it will not change. It will stay the same regardless of any Nominee or Supervisor’s fees.

The IVA fees stated below are included in your monthly contribution.

The fees are as follows:

Nominee Fees

Supervisor’s Fees

Disbursements

What Are IVA Nominee Fees?

IVA fees can be broken into different sections. Nominee Fees cover the work taken to assess your ciscumstances and to draft your proposal. It also includes the work carried out to meet with your creditors.

The fee is taken from your monthly contribution, so once you have agreed your monthly payment, that will not change. Instead, the amount of money you pay each month can be allocated to your fees in different ways across the term of your IVA.

It is important to realise that IVA charges are a standard feature in ALL IVA proposals regardless of the company that is providing the service.

What Are IVA Supervisor's Fees?

These IVA fees cover the ongoing management of your IVA throughout the term of the arrangement. This includes, dealing with creditors and administering their repayments. It also includes the production of regular reports to keep you informed of the status of your agreement.

The fee is taken as part of your monthly repayment. As stated above, it will not increase how much you pay each month.

What Are IVA Disbursement Fees?

These fees include any third party services that your IVA providers have needed to process your proposal.

This can include legal fees and license fees.

Are There Any Other Places Where I Can Get Debt Relief Information?

Here are a few websites that you may find useful;

IVA Guides and IVA Information

What Is An IVA?

An IVA can be a great, positive way to help with your debt. Allowing you to continue living your life without the stress of being chased by your creditors. Click to find out more about what an IVA is.

Is An IVA Right For You?

Whether an IVA (Individual Voluntary Arrangement) is right for you or not will largely depend on your personal situation e.g. debt level, number of creditors, affordability etc. Click to find out more.

How Does An IVA Work?

An Individual Voluntary Arrangement (IVA) is a debt solution where you agree with your creditors to pay all or part of your debts. When it is completed, any remaining debts are written off. Take a look at our article to find out more.

Which Debts Can Be Included In An IVA?

Many kinds of debts can be included in an IVA. IVAs are limited to unsecured debts but by solving your unsecured debt problems, you may find paying any secured debt much easier.

How Do I Apply For An IVA?

Applying for an IVA (Indivudual Voluntary Arranagement) is a fairly straightforward process. Click the button below and a member of our team will contact you and guide you through the process.

What Are The Pros & Cons Of An IVA?

As with many things in life, there are benefits and consequences we need to consider. Take a look at our Pros and Cons article to find out whether an IVA is right for you

Does An IVA Have Fees?

Setting up an IVA does incur some costs; however, you will not be expected to pay anything up front at the beginning of the arrangement and there will be no surprise costs at the end of the arrangement.

Logbook Loan Debt

A logbook loan involves borrowing a sum of money secured against your car. By signing up to a logbook loan, you are essentially passing the ownership of your car to the lender in exchange for money. However, you are still allowed to use the car.

Mortgage & Rent Debt

Most people who own their own home, do so with a mortgage. This is a long-term loan, often over the course of 25-30 years, which allows people to borrow sums large enough to cover most of the costs of buying a house.

Secured Loan Debt

When lending money to consumers, some companies like to have the security of attaching the loan to your assets. This gives them the peace of mind that, if something went wrong, they would be able to recover some or all the money through the sale of your property.

Hire Purchase Debt

Hire Purchase (HP) is a type of finance agreement that is often used to purchase motor vehicles or household goods e.g. white goods and furniture. When purchasing vehicles or goods through an HP agreement, you won’t actually own the goods until the last payment has been made and the debt has been cleared.

Council Tax Debt

Council Tax is a yearly fee paid to your local authority, used to pay for all the public services that are in your local area. These include refuse collection, police and fire services, leisure facilities, educational facilities etc. Council tax can either be paid in twelve or ten monthly instalments: the latter giving you two months of payment holiday.

Credit Card Debt

A credit card is a convenient way to borrow money from a bank or lender via the use of a plastic card. You can make purchases in much the same way as when using a debit card. This spending accrues a debt which will have to be paid back at a later date.

Gambling Debt

In simple terms, gambling debt is when a person owes money to a bookmaker or casino. However, things can often become more serious than that, where an individual uses other means of credit to cover their gambling losses.

HMRC Debt

HMRC arrears is any debt amount that relates to Income Tax, National Insurance, VAT or Tax Credit Overpayments. These are ‘High-Priority’ debts and since the consequences can be severe, should be dealt with as soon as possible.

Overdraft Debt

An overdraft is an agreed amount of credit attached to a bank account. It allows your account to fall into a negative balance, where you have spent more than you had in the account. Provided you stay within the agreed limit, this facility should always be available. However, the bank does have the right to withdraw it at any time.

Payday Loan Debt

A Payday Loan allows you to borrow a small amount of money and pay it back once you have received your next wage. This helps you to cover a shortfall in money that may have occurred due to an emergency. They usually carry a high interest rate but can be applied for very quickly in comparison to other types of credit.

Personal Loan

A personal loan is when you borrow an amount of money from a bank, building society or other creditor, agreeing to pay it back over a set repayment term. You will be expected to make equal monthly repayments.

Student Loan Debt

With ever increasing tuition fees, rental prices and living costs, going to university is more expensive than ever. Due to these prohibitive costs, it is incredibly typical for a person to take out student loans and they should, by no means, be considered a bad thing. Unfortunately, for many, they are simply the price of a good education.

Catalogue Debt

Catalogues remain an extremely popular way of purchasing goods for many people, especially around those times of year when money can be short e.g. Christmas and Birthdays.

Store Card Debt

Credit through store cards works in a very similar way to a credit card, however it only authorises you to purchase goods from the store that issued the card. This facility allows you to buy now and pay later or to pay for your goods in instalments if you choose to.

Utility Bills Debt

Few things in life are more essential than your utilities and it’s not an overstatement to say that water, electricity and gas are three things few people can live without. Whether that’s for hydration and sanitation, heating or cooking, or even access to the internet and television, having any of these utilities taken away is unthinkable.

Are IVAs Worth It?

When looking into how an IVA works, there are some features that do appear to be too good to be true, so it is understandable that some people are extremely cautious and even cynical when thinking about whether to proceed.

Is an IVA a Bad Idea?

Whether an IVA is a good or bad idea is largely dependent on your financial circumstances. Of course, every debt solution is going to have its advantages and disadvantages. These need to be considered and weighed up so that you can make an informed choice.

Do You Lose Assets With An IVA?

Assets are the things you own, whether that’s a house, car or electronic equipment. Many people, when entering any debt solution, are often concerned about how much they will lose and to which extent their lives will be altered. Read on to find out more about how an IVA might impact on your assets.