Write Off Debt - How To Write Off Debt

Write Off Debt - How To Write Off Debt

You Could Write Off Up To 85% of Your Unaffordable Debt

- Clear Your Debt With One Affordable Month Payment

- Free Consultation

- Find The Solution That Best Fits Your Needs

Table of Contents

Can Debt Be Written Off?

The short answer to this question is that debt can be written off, but the type of debt and your personal circumstances are incredibly important when determining if you and your debt qualify for a write off.

At any point, a person in debt has the right to contact their creditor and request to have debt written off. However, since most businesses are commercially driven, it is highly unlikely that they would agree to this unless they accepted that it was highly unlikely that they would be able to collect it.

This is where formal debt solutions come into play. With a debt solutions like an IVA, creditors can be left with no choice but to write off either all or a significant portion of your debt. This is because the decision whether or not to allow you onto an IVA comes down to a vote between your creditors. Some creditors will vote in favour and others could reject, some may not vote at all, but as long as the vote is in your favour, any rejecting creditors will be obliged to accept the IVA.

Read on to find out how you could have up to 85% of your unsecured debt written off.

Which Types Of Debt Can Be Written Off?

Debt is often split into two main categories; secured and unsecured.

Secured Debt

Secured debt is when you borrow money that is secured against property or the items you have purchased.

A good example of this is a mortgage. If you pay your mortgage in the normal way, then eventually, you will own the property outright. However if you default on the mortgage, the house could be repossessed and this would cover most if not all of the debt.

In a similar way, if you were to default on a car loan, rather than your debt being sold to a debt collector, for example, the car would instead be repossessed and that would cover most if not all of the debt.

It is highly unlikely that a creditor for secured debt would ever agree for a debt to be written off since they always have the option of repossessing whichever property or item the loan was secured against and recovering their money that way.

Examples of secured debt are:

Unsecured Debt

Unsecured debt is when your borrow money that is not secured against property or the items you purchased. Instead, a creditor will rely on your credit score to determine whether you are suitable to borrow money from them.

Because this debt is not secured and the option of repossessing property or items is not available for the creditor, it is much more likely that, under the terms of a debt solution, a creditor will agree to a write off.

Examples of unsecured debts are:

- Rent Arrears

- Buy Now Pay Later Debt

- Council Tax Debt

- Gambling Debt

- Overdraft Debt

- Personal Loan Debt

- Student Debt

- Catalogue Debt

- Credit Card Debt

- HMRC Debt

- Payday Loan Debt

- Store Card Debt

- Utility Bill Debt

Out of these debts, only Student Loan Debt cannot be written off via a IVA. All the other unsecured debts listed above have the potential to be written off. Bear in mind though, that there are other factors that your Insolvency Practitioner would consider, such as income and expenditure and whether you already have a debt solution amongst others.

Help Is Just A Few Clicks Away...

By answering a few simple questions, we can begin your journey towards being debt free

Which Debt Solutions Write Off Debt?

In the UK, there are a host of different solutions that are available to those struggling with debt. Some of these are considered insolvency solutions that involve the writing off of all or a portion of your debt, others are less formal and could simply allow an individual a longer payment term to clear debts.

Below, we will briefly run through the different debt solutions available.

Insolvency Solutions for England, Wales and Northern Ireland

- Bankruptcy – This is the most extreme solution. All of your unsecured debts would be written off and any property or assets like your home, cars and other valuable items may be sold to help clear your debt. To find out more, visit our bankruptcy page.

- Debt Relief Order – If you have a low income and you do not own your own home, a DRO could be suitable for you. By the end of the DRO period, your unsecured debt would be written off. To find out more, visit our Debt Relief Order Page.

- Individual Voluntary Arrangement – During the IVA’s 5-6 year period, you will make affordable payments towards your debt. At the end of the period, any debt that remains will be written off. To find out more, visit our IVA page

Write Off Debt Solutions in Scotland

Debt Write Off and Insolvency Solutions for Scotland

- Sequestration – Scotland’s equivalent to bankruptcy. As with bankruptcy, your unsecured debt would be written off and assets like your home and car would be sold to help clear your debt. To find out more, visit our sequestration page.

- Protected Trust Deed – During the PTD’s 4 year period, you make affordable payments towards your debt. Once the period has ended, your remaining debt is written off. To find out more, visit our Trust Deed page.

- Minimal Asset Process – This is another type of bankruptcy aimed at people with low income and few assets. To find out more, visit our MAP page.

Does Writing Off Debt Affect Your Credit Rating?

There are a few things to consider here when thinking about credit scores and ratings.

If you are someone who has already defaulted on a loan, or has missed some repayments, then your credit score will already have been affected. This means that if your score is already low, then a debt solution may not make much more of a difference.

However, if you are someone who is seriously struggling, but up to this point you have been able to keep up with repayments, or you have only missed one or two, then your credit score could be significantly affected.

Whatever the situation, a debt solution will stay on your credit file for 6 years from the date it began. So if you entered into an IVA, for example, by the time the IVA period is finished, your credit score could be beginning to recover.

What Difference Could A Debt Write Off Solution Make To Me?

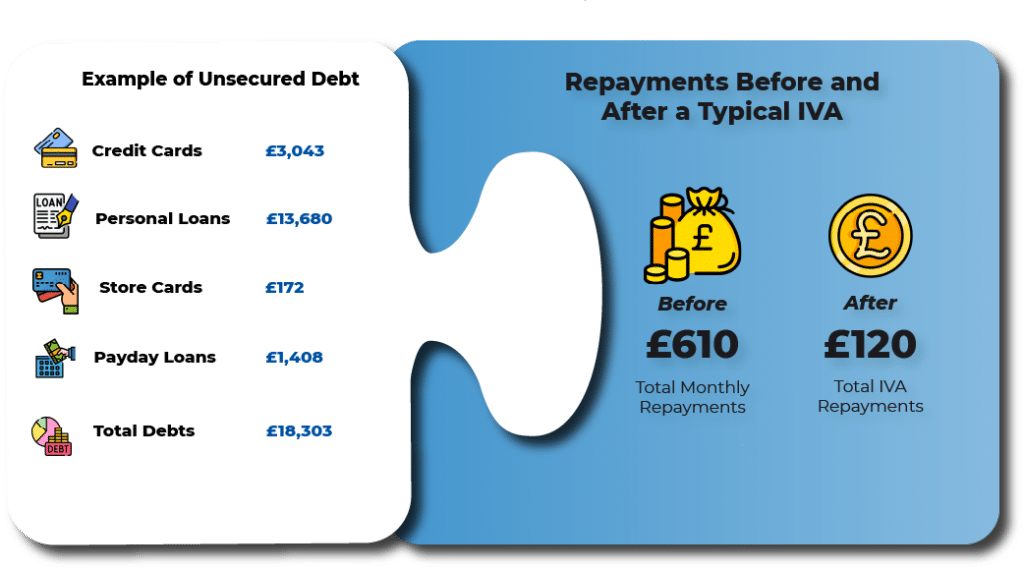

The picture above is based upon a genuine case we have been able to help with.

As you can see, the individual concerned had a significant debt of £18,303 and was expected to pay an amount per month they couldn’t afford.

During the IVA consultation, it was established that once all bills and reasonable lifestyle costs had been taken into account (not including their debt repayments), they had £120 per month left.

That meant that without an IVA, they were trying to pay £610 per month towards their debt with only £120 available. Instead the £120 became their IVA repayment, meaning they could get on with their lives knowing they could now afford their debts. The seriousness of their situation had played heavily on their mind but now they could budget sensibly having had expert advice. Their mental health was being put under tremendous pressure but now they can genuinely see a way forwards to becoming debt free.

IVA Guides & Information to Help With Writing Off Debts

What Is An (Individual Voluntary Arrangement)?

An IVA can be a great, positive way to help with your debt. Allowing you to continue living your life without the stress of being chased by your creditors. Click to find out more about what an IVA is.

Is An Individual Voluntary Arrangement Right For You?

Whether an IVA (Individual Voluntary Arrangement) is right for you or not will largely depend on your personal situation e.g. debt level, number of creditors, affordability etc. Click to find out more.

How Does An Individual Voluntary Arrangement Work?

An Individual Voluntary Arrangement (IVA) is a debt solution where you agree with your creditors to pay all or part of your debts. When it is completed, any remaining debts are written off. Take a look at our article to find out more.

Which Debts Can Be Included In An Individual Voluntary Arrangement?

Many kinds of debts can be included in an IVA. IVAs are limited to unsecured debts but by solving your unsecured debt problems, you may find paying any secured debt much easier.

How Do I Apply For An Individual Voluntary Arrangement?

Applying for an IVA (Indivudual Voluntary Arranagement) is a fairly straightforward process. Click the button below and a member of our team will contact you and guide you through the process.

What Are The Pros & Cons Of An Individual Voluntary Arrangement?

As with many things in life, there are benefits and consequences we need to consider. Take a look at our Pros and Cons article to find out whether an IVA is right for you

Does An Individual Voluntary Arrangement Have Fees?

Setting up an IVA does incur some costs; however, you will not be expected to pay anything up front at the beginning of the arrangement and there will be no surprise costs at the end of the arrangement.

Other Debt Solution Guides & Information

Administration Order

For people who have one or more county court judgement made against them, an administration order is a legally binding debt solution which allows you to pay your debt back based on what you can afford.

Bankruptcy

Bankruptcy is a legally binding debt solution. It is often seen as a last resort if other debt solutions fail or can’t be completed within a reasonable timeframe. It is a process whereby debt is written off.

Debt Consolidation Loan

A debt consolidation loan can be an effective way of paying off debt to multiple creditors and combining it into one affordable payment. This allows you to reduce your monthly amount at the cost of more interest.

Debt Management Plan

A Debt Management Plan is an agreement between you and your creditors to reduce your monthly payments. It isn’t a legally binding agreement but can be negotiated by you or a third party on your behalf.

Debt Relief Order

Designed for individuals with very little disposable income, the Debt Relief Order can be accessed if you don’t own your own home and have a debt of no more than £30,000. It is used as an alternative to an IVA.

Debt Settlement Offer

If you acquire a lump sum of money and you have troublesome debts, then a Debt Settlement Offer can enable you to pay that debt at a reduced amount. The repayment is negotiated between you and your creditors.