Getting Finance With An IVA | Loans With IVA | IVA Loans

Getting Finance With An IVA | Loans With IVA | IVA Loans

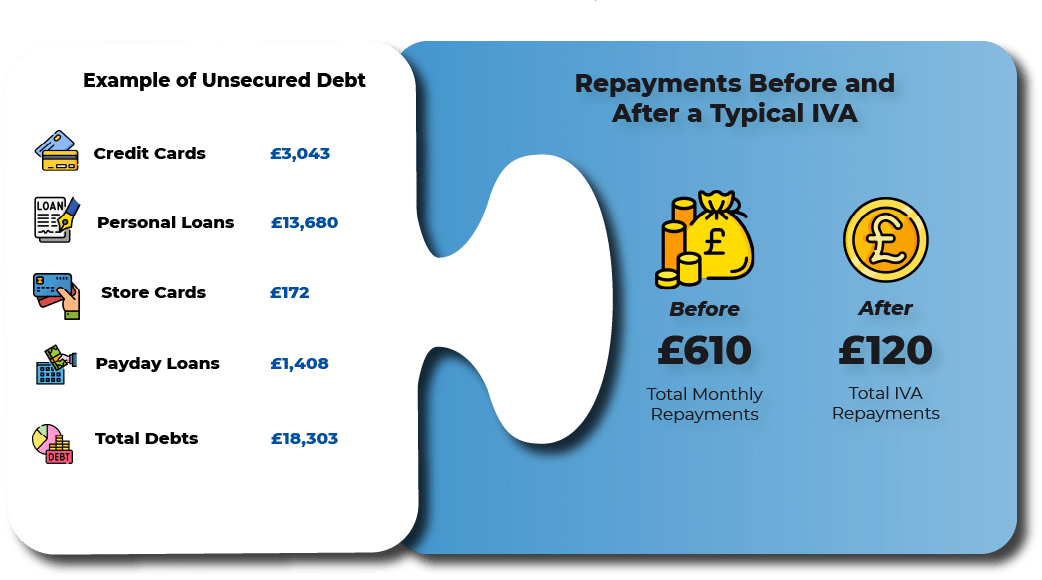

Clear Your Debt With One Affordable Monthly Payment

- Clear Your Debt With One Affordable Month Payment

- Free Consultation

- Find The Solution That Best Fits Your Needs

Table of Contents

Whether it’s a personal loan, credit card or even car finance; borrowing of any kind can be a challenge when on an IVA. In this article, we will cover what the rules are for obtaining finance during your 5 year IVA period.

What Is An IVA (Individual Voluntary Arrangement)?

An IVA can be a great, positive way to help with your debt. Allowing you to continue living your life without the stress of being chased by your creditors

An Individual Voluntary Arrangement (IVA) is a debt solution where you agree with your creditors to pay all or part of your debts. This agreement is set up and managed by an Insolvency Practitioner (IP), who will receive an agreed monthly payment from you and will divide it amongst your creditors.

if you apply for an IVA ,then this agreement could allow you to write off up to 81% of your total debt based on government legislation and will often give you a greater level of control than bankruptcy.

Once your IVA has been agreed and set up, your creditors can no longer take action against you and won’t be able to contact you, but it will affect your credit rating for six years, making it difficult to get further credit during this period. Your details will also be placed on The Register of Insolvencies, which is a public record, while you clear your debts.

For the duration of your IVA, all fees and interest relating to your debt is frozen and once completed, the remainder of your debt is written off, allowing you to begin again, debt free.

This agreement is available to residents of England, Wales and Northern Ireland. If you live in Scotland, then you could pursue an agreement called a Trust Deed to help you with your debt.

Do I Qualify for an IVA (Individual Voluntary Arrangement)?

In order to qualify for an IVA, you must meet the following criteria:

Have £5000 or more unsecured debt

Owe money to two or more creditors

Live in England, Wales or Northern Ireland

Have a regular income and be able to meet a monthly payment of at least £85.

Can I Get A Loan While In An IVA?

The standard answer to this question is that, in most cases, it is prohibited to take out more than £500 of credit.

Rules like this, whilst sometimes frustrating, are there to encourage IVA clients to not rely so much on credit in the future. It is also worth remembering that during your IVA application your income and expenditures are assessed to gauge your affordability. Technically, you shouldn’t be able to afford another monthly repayment since all of your disposable income is already accounted for in your IVA.

If you do need to borrow over £500, then you would need to obtain permission from your Insolvency Practitioner and unless you can demonstrate a valid reason for doing so, your request could be rejected.

Another thing to consider is that it is likely that your credit rating will be poor during your IVA. This will make any borrowings difficult to obtain or overly expensive due to higher interest rates.

Can I Get A Credit Card While In An IVA?

A credit card with a small limit of £500 would not be impossible to get, but your poor credit rating would likely make it difficult.

Can I Get Car Finance While In An IVA?

Secured finance like a car loan can usually be taken out during an IVA as long as you obtain permission from your Insolvency Practitioner. In order for this to happen, however, it will be necessary to demonstrate why you need the vehicle. Common acceptable reasons are that you need it to maintain employment or that you are a carer.

How Soon After My IVA Has Finished Can I Get Credit?

From the date it was approved, your IVA will appear on your credit file and will potentially have a negative impact on your score. The IVA will remain there for six years, after which it will disappear, leaving you to rebuild your score.

It is worth noting that whilst your credit score is low, any borrowing that you do will almost certainly be more expensive and should be approached with caution.

It could be beneficial to to wait until your credit rating is good or higher, before attempting to borrow any money.

What Could a Typical IVA Do For Me?

IVA Guides and Information

What Is An IVA?

An IVA can be a great, positive way to help with your debt. Allowing you to continue living your life without the stress of being chased by your creditors. Click to find out more about what an IVA is.

Is An IVA Right For You?

Whether an IVA (Individual Voluntary Arrangement) is right for you or not will largely depend on your personal situation e.g. debt level, number of creditors, affordability etc. Click to find out more.

How Does An IVA Work?

An Individual Voluntary Arrangement (IVA) is a debt solution where you agree with your creditors to pay all or part of your debts. When it is completed, any remaining debts are written off. Take a look at our article to find out more.

Which Debts Can Be Included In An IVA?

Many kinds of debts can be included in an IVA. IVAs are limited to unsecured debts but by solving your unsecured debt problems, you may find paying any secured debt much easier.

How Do I Apply For An IVA?

Applying for an IVA (Indivudual Voluntary Arranagement) is a fairly straightforward process. Click the button below and a member of our team will contact you and guide you through the process.

What Are The Pros & Cons Of An IVA?

As with many things in life, there are benefits and consequences we need to consider. Take a look at our Pros and Cons article to find out whether an IVA is right for you

Does An IVA Have Fees?

Setting up an IVA does incur some costs; however, you will not be expected to pay anything up front at the beginning of the arrangement and there will be no surprise costs at the end of the arrangement.

Are IVAs Worth It?

When looking into how an IVA works, there are some features that do appear to be too good to be true, so it is understandable that some people are extremely cautious and even cynical when thinking about whether to proceed.

Is an IVA a Bad Idea?

Whether an IVA is a good or bad idea is largely dependent on your financial circumstances. Of course, every debt solution is going to have its advantages and disadvantages. These need to be considered and weighed up so that you can make an informed choice.

Do You Lose Assets With An IVA?

Assets are the things you own, whether that’s a house, car or electronic equipment. Many people, when entering any debt solution, are often concerned about how much they will lose and to which extent their lives will be altered. Read on to find out more about how an IVA might impact on your assets.