Secured Loan Debt

Table of Contents

What Is A Secured Loan?

When lending money to consumers, some companies like to have the security of attaching the loan to your assets. This gives them the peace of mind that, if something went wrong, they would be able to recover some or all the money through the sale of your property.

Since the loan is secured against your property, it allows you to borrow larger sums of money, over longer repayment periods.

How Does A Secured Loan Work?

A secured loan works in roughly the same way as any other loan. The customer applies to the lender, usually a bank or building society and they decide whether to loan you the money you have asked for. If they agree, then they will offer you an amount with interest attached.

What makes this debt ‘secured’ is that your property is used as a guarantor against the cost of the loan. This means that, should you default on the loan, you have agreed that you can be forced to sell your property.

Secured loans can sometimes take the form of a second mortgage, where the amount you can borrow, is based upon the equity that is held in the property. ‘Equity’ is any value in the property that is greater than the amount still owed on the mortgage. Sometimes these can be referred to as ‘home improvement loans’ since people will often use them for expensive home improvement work.

What Are the Advantages of a Secured Loan?

The main benefits of secured loans (sometimes called a homeowner loan) are lower interest rates and a longer repayment term, allowing the consumer to access larger amounts of money and maintain affordability. Since the borrower is taking on a substantial ‘risk’ by using their property as collateral, the lender has more confidence that they will recoup the funds, whether the loan repayments are completed or the customer defaults.

What are the Disadvantages of a Secured Loan?

A secured loan carries with it the risks that all loans carry. If you default, they will write to you demanding payment, they can use debt collectors etc. and this can also significantly impact on your credit score, affecting how easily you may get credit in the future.

What Is The Main Difference Between An Unsecured and a Secured Loan Debt?

The one main difference with a secured loan is that, if you default, you are in danger of having your house repossessed or being forced to sell the property yourself. The lender can either apply to the court for a Possession Order forcing you to leave, so they can sell or they can apply for a Bill of Sale, forcing you to sell the property yourself. Any money made from the sale will first be used to cover the debt and any fees. You will then be given any monies that are left.

Sometimes even the sale of the property doesn’t raise enough funds to clear the debt. If this is the case, then the company can still pursue you to reclaim the remaining balance. This can sometimes mean you find yourself in court once more.

What If I Can’t Keep Up With my Secured Loan Repayments?

If you fail to make payments on your secured loan, then in the first instance, the lender will write to you demanding you make a payment. As with all debt, it is important that you do not ignore this. Speaking to your creditors and being honest and clear about your circumstances is always the best approach. Remember, they can repossess your home, so keeping up to date with what is happening is vital.

What if I can’t come to an arrangement on my debt or loan?

If you cannot come to an agreement with your lender, then it is important to seek debt advice quickly. There are several formal debt solutions that can slow down or even completely stop any attempt to repossess your home.

Can I Get Secured Loan IVA?

The prospect of losing your home via repossession, whether a property you own or rent, can be a frightening one.

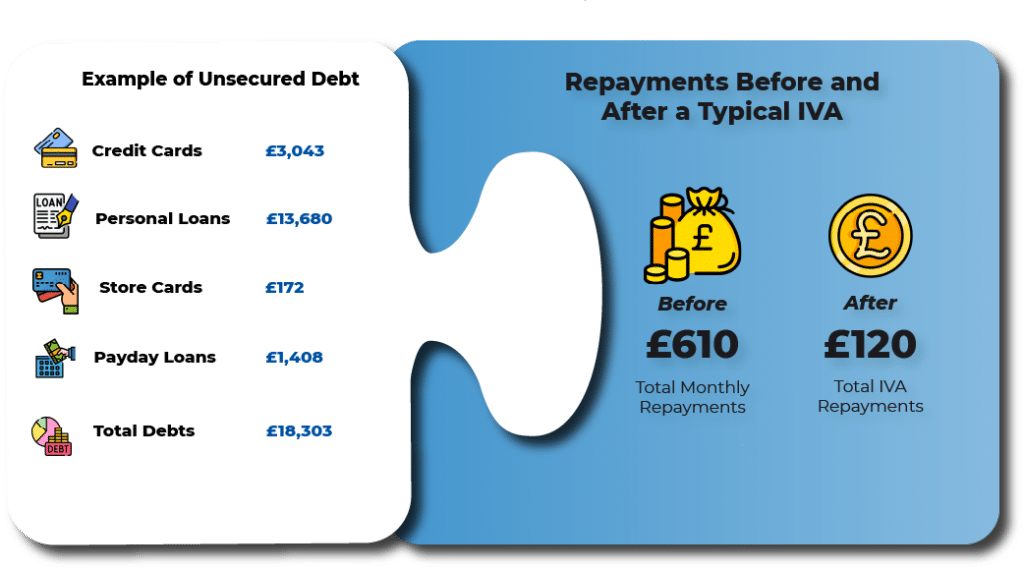

If you have a combination of secured and unsecured debts and live in England, Wales or Northern Ireland, then applying for an IVA may reduce your monthly outgoings enough to cope with your secured debt repayments.

If you live in Scotland then a Trust Deed is your equivalent solution.

If you only have secured debts and live in England, Wales or Northern Ireland, then the following solutions may work for you:

If you live in Scotland, then you could apply for:

Secured Loan Debt FAQs

Can You Settle a Secured Loan?

If your financial situation improves significantly, then you may want to settle some or all of your debts earlier than planned. You should be able to do this, as long as your lender agrees.

Can You Write Off a Secured Loan?

We often get asked whether Secured Debt can be written off. The answer to this is NO. Or at least it is highly unlikely.

What Happens if I Don’t Pay a Secured Loan?

A secured loan is attached to your property, so if you are struggling to make your repayments, then your lender could apply to the courts to have your property repossessed to pay back the debt.