Administration Order

Table of Contents

What is an Administration Order?

For people who have one or more county court judgement made against them, an Administration Order is a legally binding debt solution which allows you to pay your debt back based on what you can afford.

To apply for an Administration Order, you would need to apply to the county court, who will then decide whether your circumstances are suitable. If an Administration Order is granted, then it will include any relevant debts which you may owe. These will be packaged up together, allowing you to make one payment, which will be distributed to the creditors.

Once an Administration Order has begun, your individual creditors will no longer be able to take action against you.

How Does an Administration Order Work?

Administration Orders are controlled and maintained by your local county court. During the application process, they will decide:

How much debt you owe to creditors.

How much you can afford each month.

How long it will take you to complete your repayments.

Under an Administration Order, you will continue to make repayments until the debt is paid off. Unlike an IVA, none of the debt automatically written off.

You will be liable to pay fees every time you make a payment. This can be up to 10% of your total debt.

If your financial situation changes, then it is important that you contact the court immediately. This may result in the terms of your administration order being changed. This is especially important if your situation has become worse.

During the application period for an Administration Order, if it becomes clear that you will not be able to pay the debt back over a reasonable timeframe, then the judge may suggest a Composition Order.

A Composition Order limits the repayment period and will also write off a portion of the debt.

Once your Administration Order has completed, you are eligible to apply for a ‘certificate of satisfaction’, which you can use as proof that your debts are settled. In order to be issued with this, you will need to write to your county court and pay a £15 fee.

Who Is Eligible For an Administration Order?

In order to be eligible for an administration order, the applicant must meet the following criteria:

You must have at least one County Court Judgement which you can not pay

Your debt must not exceed £5,000

You must owe money to more than one creditor

You have enough income to make regular payments

How Do I Apply If I Have an Insolvent Estate?

To begin the Administration Order application process, you must fill in an N92 form. This can be found here.

Once the application form is filled in, you should take it or send it to your local county court, who will help you through the the process of your Administration Order.

Which of My Debts Can Be Included in an Administration Order?

An Administration Order can include any kind of debt, including mortgage or rent arrears. It is important to note that this may not stop your mortgage lender or landlord from repossessing your home or property.

Debts include:

Secured Debts

Unsecured Debts

What Are The Advantages of an Administration Order?

Settling debt through an Administration Order payplan can have several benefits:

All your debts are packaged into a single monthly payment, meaning you will no longer need to deal with all your creditors separately.

The creditors included in the order can no longer pursue your debt.

At the end of the agreement, you will be free of the debts.

What Are The Disadvantages of an Administration Order?

Administration Orders can have a number of disadvantages:

They are only available to people if their debt does not exceed £5,000.

Failing to make the agreed repayments will allow the court to apply for an ‘Attachment of Earnings Order’. This means that payments can be taken straight from your wages.

If you fail to make your payments the agreement can be cancelled.

The fees can be 10% of your total debt.

An Administration Order is added to the Register of Judgements, Orders and Fines. Your details will stay on the register for six years, affecting your credit rating during this time.

Who Can Help Me If I'm Struggling With Debt

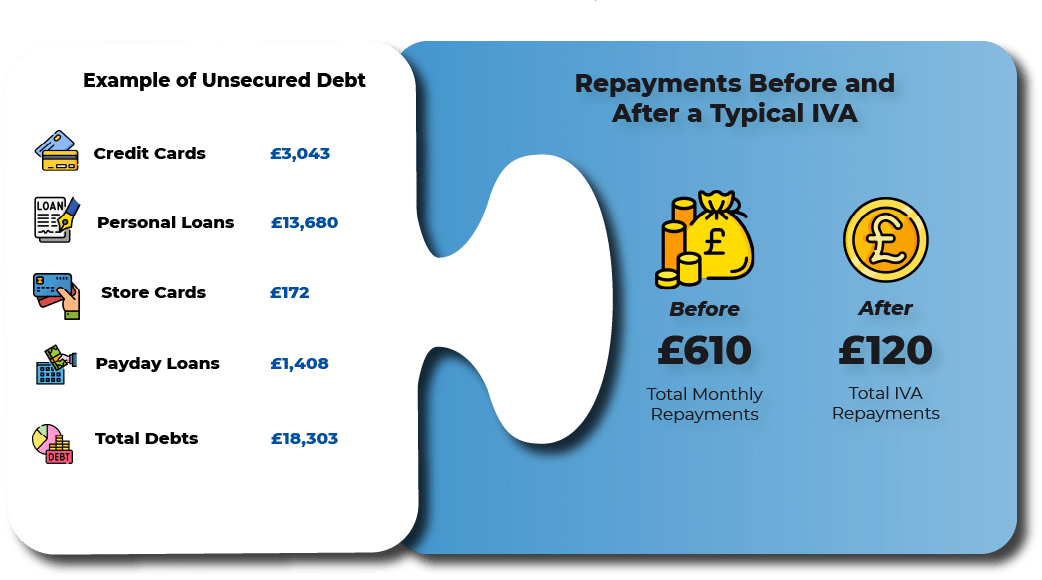

If you are having difficulties with your debt or perhaps you are currently the subject of an administration order. Debt Help is available and maybe there could be a better way to clear your debt. Contact IVA4Me and take that first step towards a new life.

Administration Order FAQs

How Long Does An Administration Order Take?

To apply for an Administration Order you first need to fill in an application form and hand it in to your local court. The N92 form can be found here.

What Is an Administration Order?

For people who have one or more county court judgement made against them, an administration order is a legally binding debt solution which allows you to pay your debt back based on what you can afford.