Debt Consolidation Loan

Table of Contents

What Is A Debt Consolidation Loan?

There are several different types of loans. But, what is a debt consolidation loan? A debt consolidation loan can be an effective way of paying off debt to multiple creditors and combining it into one affordable payment

It is a new loan that you can take out, where the funds are solely used to pay off other debts. By putting all the debt together, it allows you to stretch the payment term of some or all the debt and possibly pay it at a lower interest rate. This usually results in a significant reduction of monthly outgoings.

What Are The Different Types of Debt Consolidation Loan?

Consolidation loan finance falls into two categories:

Secured Debt Consolidation: This loan is usually secured against your home or property. This means that if you don’t keep up with the repayments, your home could be at risk. This is often the most affordable finance option for a homeowner.

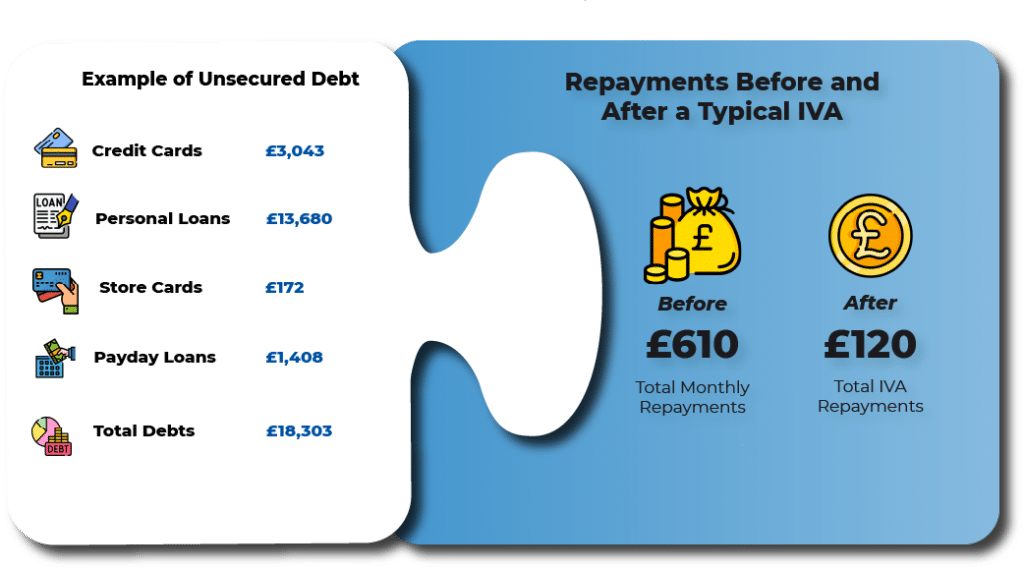

Unsecured Debt Consolidation: Depending on your credit history, this type of loan usually allows you to borrow up to £25,000. The interest rate will often be higher than a secured loan and will, again, depend on your credit rating.

Do You Qualify for a Debt Consolidation Loan?

To be eligible for a consolidation loan credit you must meet the following criteria:

Have the financial stability to meet the repayments

Have a secure and steady job

Have a good credit rating

Haven’t consolidated debt before

Of course, lenders will decide whether to grant you a loan based on your individual circumstances.

Which Debts Can I Consolidate?

Since you are simply receiving borrowed money from a lender with the purpose of paying off other debts, you can consolidate pretty much any type of debts. These include:

What Are the Advantages of a Debt Consolidation Loan?

All of your debt is combined into one monthly payment

It is not placed on any Public Insolvency Register

It can often allow you to pay your debts over a longer period of time

I could reduce your monthly outgoings

If you meet your payments reliably, then it could have a positive impact on your credit rating

What Are the Disadvantages of a Debt Consolidation Loan?

- None of the debt is written off, so you must pay it in full

You may need a good credit rating to qualify

The loan could lead you to pay more in the long run.

If you choose a secured loan, your property could be at risk if you fall behind on your payments

It could take longer to repay your debt

Who Can Help Me If I'm Struggling with My Debt?

If you are struggling with your debt and have a steady income, then a consolidation loan may be a good option for you. Whilst debt consolidation loans work, if you have a poor credit rating, then you may be rejected. Contact IVA4Me to find out what other options there may be.

Debt Consolidation Loan FAQs

What Is An Advantage of Getting a Debt Consolidation Loan?

When considering a Debt Consolidation Loan, it is important to be aware of the advantages and disadvantages involved before you take the plunge. Debt Consolidation, involves taking out a loan in order to pay off several separate debts e.g. two credit cards and an overdraft.

Why Can’t I Get a Loan to Consolidate Debt?

It is important to remember that lenders base their entire business model on granting loans to people, so they can make money from the interest. So, if you have had a Debt Consolidation Loan application declined, there must be a reason. Read on to find out what the most common reasons are for a declined Consolidation Loan application.

Does A Debt Consolidation Loan Really Work?

If you have a decent credit score, but you are finding it difficult to meet your debt repayments, then consolidating your debt can often be an effective way of reducing your monthly outgoings. But is it always a good idea?