DCBL - Debt Collection Bailiffs Ltd - Stop Bailiffs Now

Instead of paying your bailiff, we could write off up to 85% of your unaffordable debt

How Will Debt Collection Bailiffs Ltd Chase Me?

DCBL, will often follow these steps to chase your debt:

You are likely to receive a phone call from DCBL along with a letter. The letter will include details of the total amount of debt owed, along with any penalty charges applied (these are outlined above). You will also be given a tight deadline within which you will be expected to pay in full.

This could be followed by a home visit asking for payment in full or to seize items or vehicles from your property to the value of your debt.

If the debt isn’t paid before the deadline, then you will often be issued with a County Court Judgement (CCJ).

Threaten bankruptcy if the debt isn’t paid either with money or via the sale of your belongings.

Take the first steps towards your new debt free life with IVA4Me. Here's what you need to do!

Click to Request A Call Back

A few quick questions will help our advisors know how to best start your process

Or Click to Contact Us

Speak to one of our debt specialists for your debt consultation

We Will Do The Rest

We will give you all the information you will need to choose a plan, based on all the facts

What Types of Debt Do They Collect?

- Parking fines

- Court fines

- Council tax arrears

- CCJs

- Family court judgements

What Are My Options?

Paying DCBL is not your only option under these circumstances.

If you are being pursued, then it’s still not too late to seek debt help from IVA4Me.

Once you begin your IVA application, an IVA proposal will be sent to all your creditors, including your bailiffs. This will often result in your creditors ceasing their action.

Bailiff Fees:

- Letter to inform you of the debt – £75

- Home/Office Visit – £235

- Removal/Selling of belongings – £110

IVA Information and Guides

What Is An IVA?

An IVA can be a great, positive way to help with your debt. Allowing you to continue living your life without the stress of being chased by your creditors. Click to find out more about what an IVA is.

Is An IVA Right For You?

Whether an IVA (Individual Voluntary Arrangement) is right for you or not will largely depend on your personal situation e.g. debt level, number of creditors, affordability etc. Click to find out more.

How Does An IVA Work?

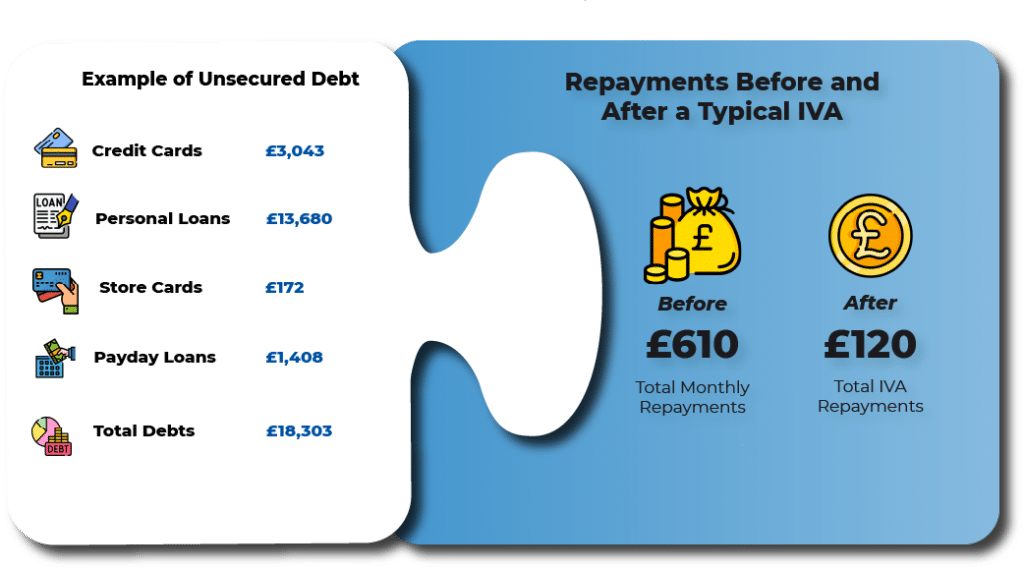

An Individual Voluntary Arrangement (IVA) is a debt solution where you agree with your creditors to pay all or part of your debts. When it is completed, any remaining debts are written off. Take a look at our article to find out more.

Which Debts Can Be Included In An IVA?

Many kinds of debts can be included in an IVA. IVAs are limited to unsecured debts but by solving your unsecured debt problems, you may find paying any secured debt much easier.

How Do I Apply For An IVA?

Applying for an IVA (Indivudual Voluntary Arranagement) is a fairly straightforward process. Click the button below and a member of our team will contact you and guide you through the process.

What Are The Pros & Cons Of An IVA?

As with many things in life, there are benefits and consequences we need to consider. Take a look at our Pros and Cons article to find out whether an IVA is right for you

Does An IVA Have Fees?

Setting up an IVA does incur some costs; however, you will not be expected to pay anything up front at the beginning of the arrangement and there will be no surprise costs at the end of the arrangement.