Bristow & Sutor

- Stop Debt Collector Action Today

- Write Off Up To 85% Of Your Debt

- Clear Your Debt With One Affordable Month Payment

Table of Contents

If you have recently received a letter, phone call or even a visit to your home from Bristow and Sutor, then one of the companies you owe money to will have hired them to collect on that debt. For many of our clients, this can be an incredibly worrying time.

In this article, we aim to offer you some advice and guidance on how this has happened, how Bristow and Sutor tend to operate and what your options are, giving you the best chance of a positive outcome.

Who Are Bristow and Sutor?

Based in Redditch, Worcestershire, Bristow and Sutor are a Bailiff or ‘Enforcement Agency’ who are usually hired by local authorities across the UK to collect outstanding Council Tax debt and Parking fines that they have failed to collect themselves. Companies like Bristow and Sutor will also buy debts from other companies at a fraction of their face value and collect the original value, giving them a profit.

It is important to realise that it is unlikely that you will owe money directly to Bristow and Sutor, but rather the debt will be owed to the original creditor, most likely your local authority.

Bristow and Sutor are a legitimate company and are considered to be one the UK’s leading ‘Enforcement Agents’.

Help Is Just A Few Clicks Away...

By answering a few simple questions, we can begin your journey towards being debt free

Why Have Bristow and Sutor Contacted Me?

If Bristow and Sutor has contacted you, it is likely that you owe money to your local authority, either from Council Tax or a PCN (Penalty Charge Notice) and the local authority has instructed them to collect it on their behalf.

A company like Bristow and Sutor will often come into action once your creditor has exhausted their own debt collection options.

Like most debt collection or bailiff firms, Bristow and Sutor will use a range of methods to reclaim that debt, including phone calls, letters and even home visits. If you fail to respond to these methods, then they can even take court action.

It is essential, at this point, that you begin to engage with your debt and take action.

Could Bristow and Sutor Take Me To Court?

The short answer to this question is YES. If you fail to engage with Bristow and Sutor and their efforts to contact you and discuss your debt, or if you fail to stick to any repayment plans they have set, then they could obtain a CCJ (County Court Judgement).

Once this CCJ is obtained, they will be authorised to begin enforcement action.

An instruction to a bailiff WILL result in them taking action such as, visiting your home and taking items to the value of the debt, applying for an Attachment of Earnings, whereby money will be taken directly from your income or they could issue a Statutory Demand, possibly resulting in you being made bankrupt.

What Options Do I Have?

Of course, the first option is to attempt to settle you debt with your local authority. But if you are unable to do this or if your Council Tax debt is only one of a number of debts your struggling with, then there is another way.

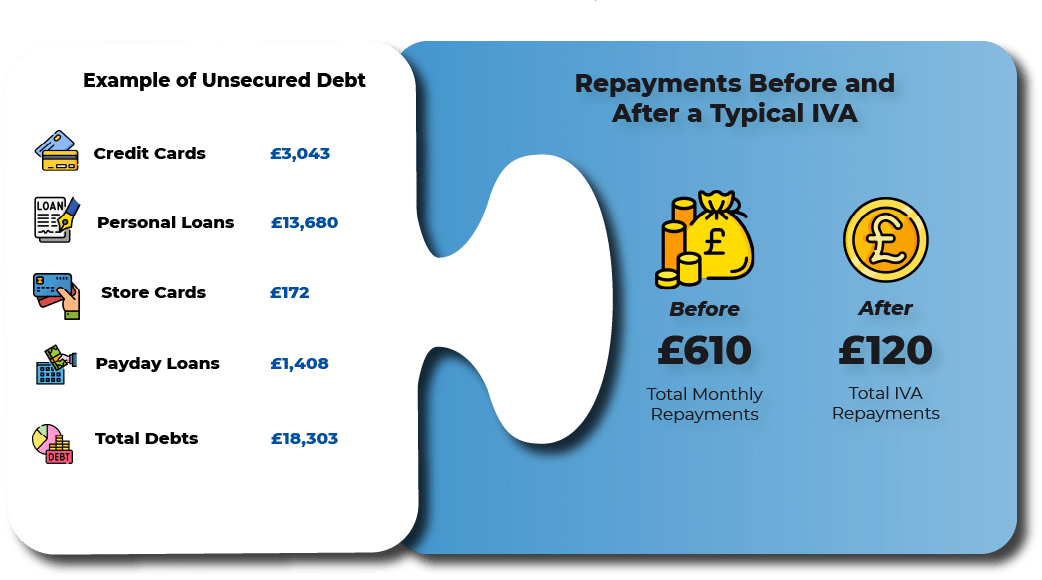

By entering into an Insolvency Debt Solution such as an IVA (Individual Voluntary Arrangement), you could tackle your debt by making one affordable monthly repayment towards your debt for a period of five years. This monthly repayment is based upon what you can afford NOT the amount you owe.

Once the five year period has ended, whatever balance is left to pay is automatically written off. Leaving you to start again.

It is typical for this amount to be around 75% of our client’s debt, however it is not unusual for this write off amount to reach up to 85% of the original arrears.

Below is an example of a real life IVA.

IVA Guides and Information

What Is An IVA?

An IVA can be a great, positive way to help with your debt. Allowing you to continue living your life without the stress of being chased by your creditors. Click to find out more about what an IVA is.

Is An IVA Right For You?

Whether an IVA (Individual Voluntary Arrangement) is right for you or not will largely depend on your personal situation e.g. debt level, number of creditors, affordability etc. Click to find out more.

How Does An IVA Work?

An Individual Voluntary Arrangement (IVA) is a debt solution where you agree with your creditors to pay all or part of your debts. When it is completed, any remaining debts are written off. Take a look at our article to find out more.

Which Debts Can Be Included In An IVA?

Many kinds of debts can be included in an IVA. IVAs are limited to unsecured debts but by solving your unsecured debt problems, you may find paying any secured debt much easier.

How Do I Apply For An IVA?

Applying for an IVA (Indivudual Voluntary Arranagement) is a fairly straightforward process. Click the button below and a member of our team will contact you and guide you through the process.

What Are The Pros & Cons Of An IVA?

As with many things in life, there are benefits and consequences we need to consider. Take a look at our Pros and Cons article to find out whether an IVA is right for you

Does An IVA Have Fees?

Setting up an IVA does incur some costs; however, you will not be expected to pay anything up front at the beginning of the arrangement and there will be no surprise costs at the end of the arrangement.

Are IVAs Worth It?

When looking into how an IVA works, there are some features that do appear to be too good to be true, so it is understandable that some people are extremely cautious and even cynical when thinking about whether to proceed.

Is an IVA a Bad Idea?

Whether an IVA is a good or bad idea is largely dependent on your financial circumstances. Of course, every debt solution is going to have its advantages and disadvantages. These need to be considered and weighed up so that you can make an informed choice.

Do You Lose Assets With An IVA?

Assets are the things you own, whether that’s a house, car or electronic equipment. Many people, when entering any debt solution, are often concerned about how much they will lose and to which extent their lives will be altered. Read on to find out more about how an IVA might impact on your assets.