What Is An IVA?

Clear Your Debt With One Affordable Monthly Payment

- Clear Your Debt With One Affordable Month Payment

- Free Consultation

- Find The Solution That Best Fits Your Needs

Table of Contents

What Is An IVA (Individual Voluntary Arrangement)?

An IVA can be a great, positive way to help with your debt. Allowing you to continue living your life without the stress of being chased by your creditors.

An Individual Voluntary Arrangement (IVA) is a debt solution where you agree with your creditors to pay all or part of your debts. This agreement is set up and managed by an Insolvency Practitioner (IP), who will receive an agreed monthly payment from you and will divide it amongst your creditors.

if you apply for an IVA, then this agreement could allow you to write off up to 85% of your total debt based on government legislation and will often give you a greater level of control than bankruptcy.

Once your IVA has been agreed and set up, your creditors can no longer take action against you and won’t be able to contact you, but it will affect your credit rating for six years, making it difficult to get further credit during this period. Your details will also be placed on The Register of Insolvencies, which is a public record, while you clear your debts.

For the duration of your IVA, all fees and interest relating to your debt is frozen and once completed, the remainder of your debt is written off, allowing you to begin again, debt free.

This agreement is available to residents of England, Wales and Northern Ireland. If you live in Scotland, then you could pursue an agreement called a Trust Deed to help you with your debt.

Help Is Just A Few Clicks Away...

By answering a few simple questions, we can begin your journey towards being debt free

Do I Qualify for an IVA (Individual Voluntary Arrangement)?

In order to qualify for an IVA, you must meet the following criteria:

Have £5000 or more unsecured debt

Owe money to two or more creditors

Live in England, Wales or Northern Ireland

Have a regular income and be able to meet a monthly payment of at least £85.

Are There Different Types of IVA (Individual Voluntary Arrangement)?

Alongside a typical IVA for an employed person, there are several different types of IVA to consider, depending on your personal circumstances:

Self-Employed

IVAs for the self-employed work in a very similar way to a typical IVA, where an Insolvency Practitioner will arrange and agreement of monthly payments that you can afford. There are, however, a few differences.

Self-Employed IVAs can often be arranged in a way that allows for greater flexibility across a year. This can be good news for businesses that rely on seasonal income. A cash flow statement will need to be produced so the IP can understand your business and what you can afford.

If your business relies on Business Credit to operate during the term of the IVA, then this can be pre-agreed with your creditors. You creditors may have specific criteria that they will require you to follow to maintain the agreement.

A business may need ongoing trade with one of the creditors it has fallen into arrears with. Under these circumstances, certain Trade Creditors may be excluded from the IVA agreement, so as not to affect future business relations.

Joint IVAs

Couples with a combination of individual and joint debts can set up individual IVAs which include all their debt however, once these are agreed, they can be administered jointly, allowing the couple to pay one affordable monthly payment.

Full and Final IVAs

This can be a great option for those who want to make a one-off payment to creditors as a final settlement

This can be an appropriate option for those with adequate savings or those who are in the process of receiving sufficient funds due to the sale an asset.

This can also be an option for those with friends or family whoa are prepared to provide the funds to cover the total amount of the IVA.

What Could a Typical IVA Do For Me?

Can You Cancel an IVA (Individual Voluntary Arrangement)?

After you apply for an IVA and the process is completed, it is possible to cancel it, however if you are considering this course of action, you must discuss this with your Insolvency Practitioner.

If you choose to cancel you should consider the following:

You must cancel in writing to your IP. You will receive notice of its termination and the IVA will fail.

Your debts will no longer be written off and you will need to recommence their repayment with your creditors. It is Essential that you contact your creditors as soon as possible to arrange this

You will also need to pay your IVA provider for their services so far.

IVA Guides and Information

What Is An IVA?

An IVA can be a great, positive way to help with your debt. Allowing you to continue living your life without the stress of being chased by your creditors. Click to find out more about what an IVA is.

Is An IVA Right For You?

Whether an IVA (Individual Voluntary Arrangement) is right for you or not will largely depend on your personal situation e.g. debt level, number of creditors, affordability etc. Click to find out more.

How Does An IVA Work?

An Individual Voluntary Arrangement (IVA) is a debt solution where you agree with your creditors to pay all or part of your debts. When it is completed, any remaining debts are written off. Take a look at our article to find out more.

Which Debts Can Be Included In An IVA?

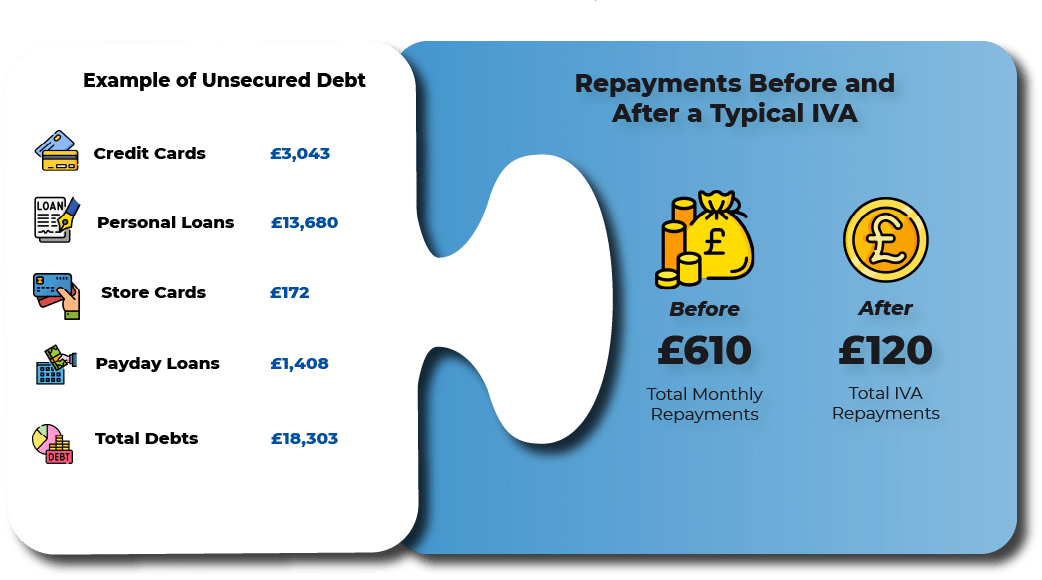

Many kinds of debts can be included in an IVA. IVAs are limited to unsecured debts but by solving your unsecured debt problems, you may find paying any secured debt much easier.

How Do I Apply For An IVA?

Applying for an IVA (Indivudual Voluntary Arranagement) is a fairly straightforward process. Click the button below and a member of our team will contact you and guide you through the process.

What Are The Pros & Cons Of An IVA?

As with many things in life, there are benefits and consequences we need to consider. Take a look at our Pros and Cons article to find out whether an IVA is right for you

Does An IVA Have Fees?

Setting up an IVA does incur some costs; however, you will not be expected to pay anything up front at the beginning of the arrangement and there will be no surprise costs at the end of the arrangement.

Are IVAs Worth It?

When looking into how an IVA works, there are some features that do appear to be too good to be true, so it is understandable that some people are extremely cautious and even cynical when thinking about whether to proceed.

Is an IVA a Bad Idea?

Whether an IVA is a good or bad idea is largely dependent on your financial circumstances. Of course, every debt solution is going to have its advantages and disadvantages. These need to be considered and weighed up so that you can make an informed choice.

Do You Lose Assets With An IVA?

Assets are the things you own, whether that’s a house, car or electronic equipment. Many people, when entering any debt solution, are often concerned about how much they will lose and to which extent their lives will be altered. Read on to find out more about how an IVA might impact on your assets.